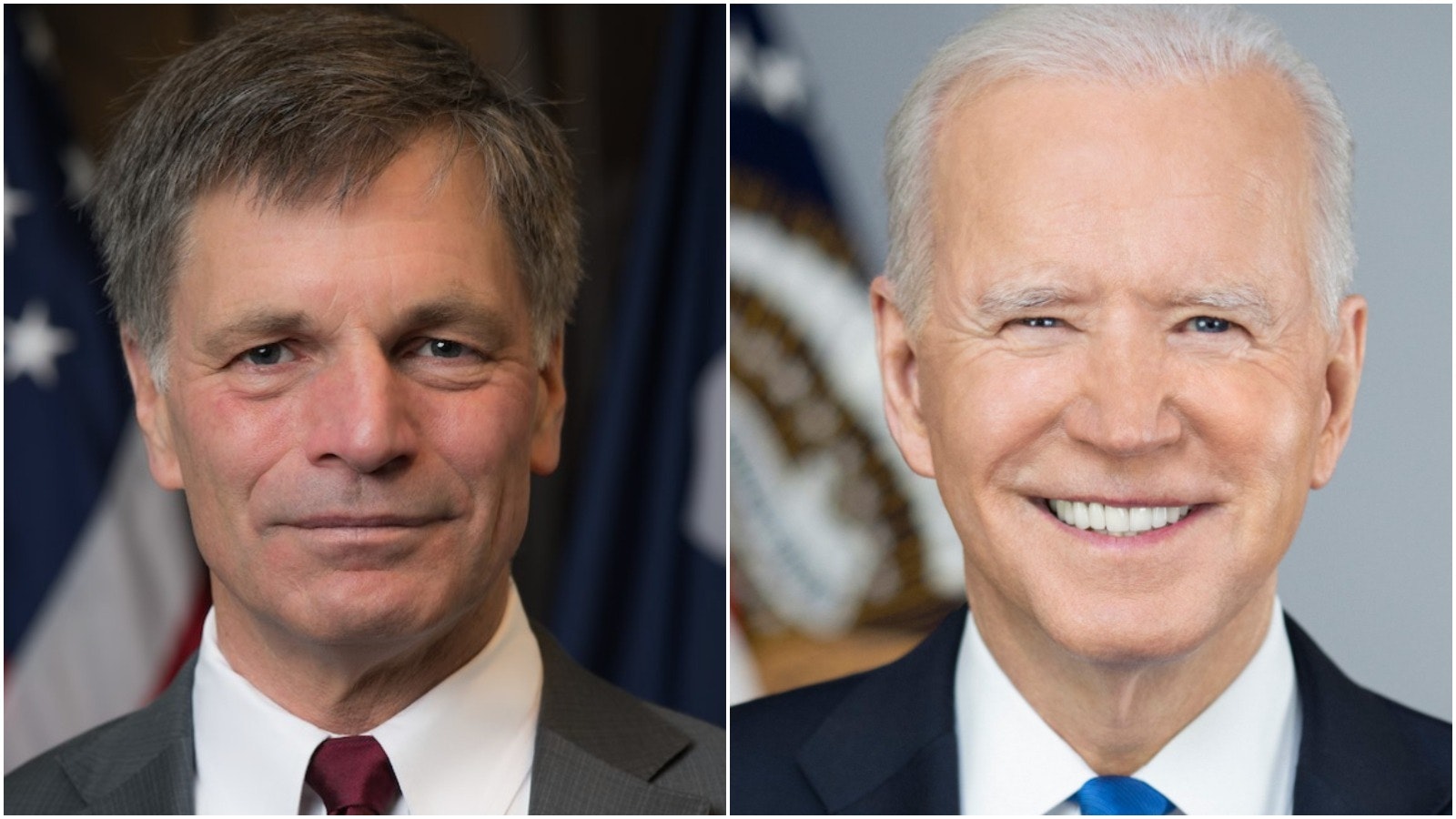

A plan to abandon a proposed mineral royalty reduction that never took effect is being criticized by Gov. Mark Gordon as the latest in a pattern of steps being taken against fossil fuels.

Gordon, in a news release, criticized the administration of President Joe Biden for trying to withdraw the royalty reduction plan offered by the administration of former President Donald Trump as another example of Biden working against fossil fuels without consulting with the country’s governors.

“The list of anti-fossil fuel actions implemented by the Biden Administration without prior consultation with fossil fuel governors just keeps getting longer,” he said. “This announcement is clearly a pattern, and the effort to justify this withdrawal based on harm to the U.S. taxpayer is disingenuous.”

The Trump administration last year proposed changes in the way oil and gas is valued for royalty payments to the federal government. The changes would have reversed some rules put in place by the administration of former President Barak Obama in 2016.

The latest rules were finalized in January, but were blocked from taking effect by the Biden administration.

The Office of Natural Resources Revenue Office on Friday announced it is proposing the withdrawal of the Trump administration rules, saying the process for their adoption “arguably was without observance of procedure required by law, as well as in excess of ONRR’s statutory authority.”

The ONRR estimated that had the Trump rules taken effect, mineral royalty payments to the federal government would have been released by $64.6 million annually.

The ONRR, in its formal proposal, also noted the reductions proposed by Trump were designed to encourage mineral production on federal lands.

“ONRR has no explicit mandate to increase production,” the proposal said.

The ONRR told E&E News that if the changes had been allowed to take effect, communities would be hurt by a reduction in their shares of royalties.

However, Gordon argued if the Biden administration was truly concerned about taxpayers, it would not have put a halt to oil and gas lease sales on federal property.

“Fossil fuel companies can only pay royalties if they are producing,” he said. “Increasing royalty rates when the coal, oil and gas industries are still attempting to recover from 2020 is just kicking the industry when it is down.”

“When those companies go out of business, no royalties are collected, less money is set aside for reclamation activities and the price of gasoline will continue to rise,” he added.