The topic of property tax relief is hot on the tongues of legislators in Cheyenne.

To be able to judge political campaign rhetoric, it is important for all Wyoming voters to understand how Wyoming’s tax structure works, and the consequences of different political options.

This column examines the technical nature of Wyoming’s property (ad valorem) tax system. An understanding of the system gives us all the ability to assess different tax relief options.

Wyoming has several sources of income. In a prior column, I talked about funding from the federal government, which comprises about one-third of the State’s revenue.

Other sources of revenue include income from the investments in the permanent mineral trust fund and common school land fund, property taxes, severance taxes, sales taxes, use taxes, fuel taxes, cigarette taxes, inheritance taxes, taxes on wind energy and taxes on nuclear power.

The largest tax source of funds used to operate the State of Wyoming’s general functions comes from sales and use taxes. On the other hand, property taxes are used to fund local governments.

Our state constitution requires property be taxes based upon the full fair market value of the property owned. So, if the value of the property goes up, the taxes go up. If the value of the property goes down, the taxes go down.

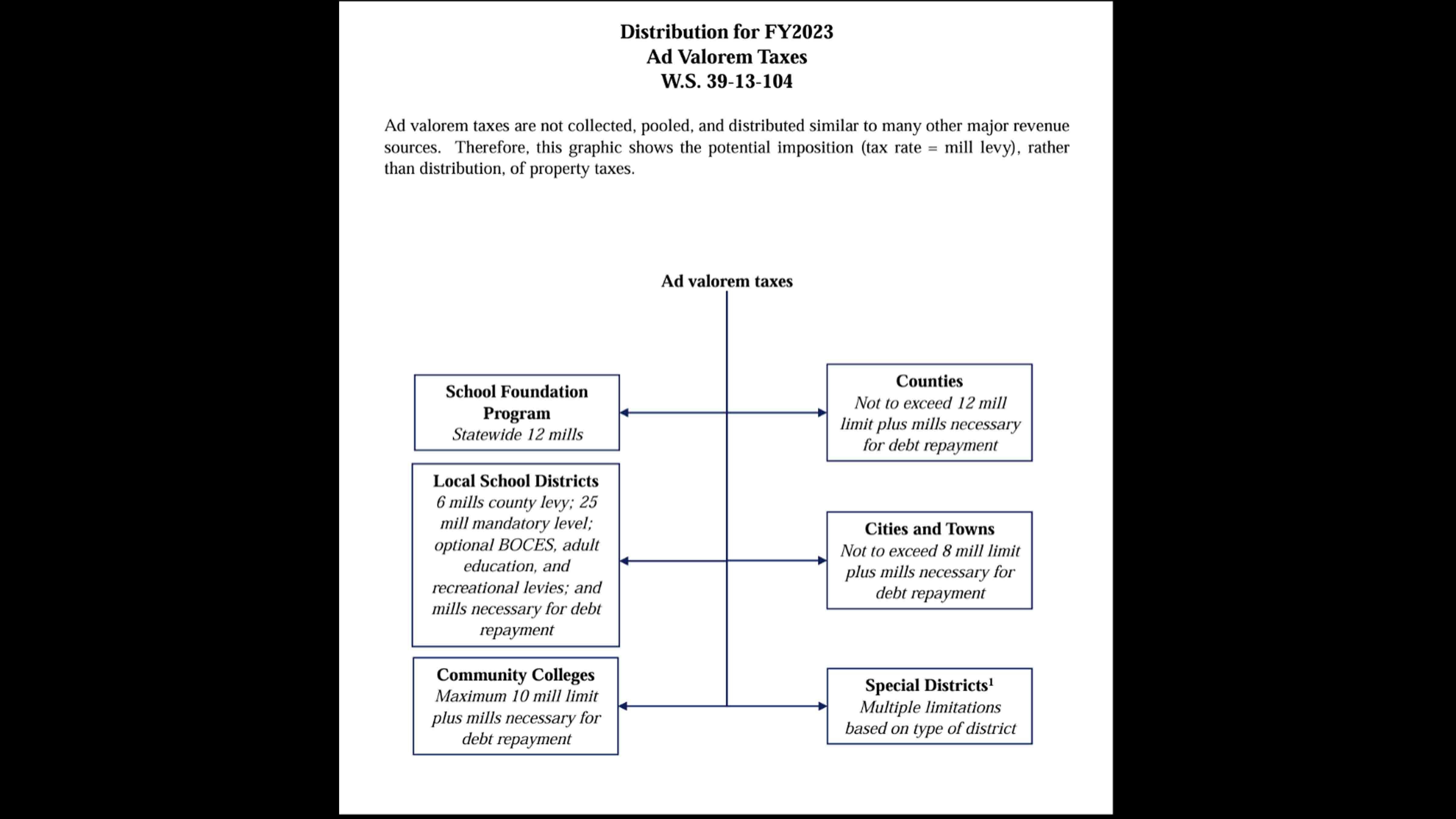

Property taxes are specifically allocated by statute.

The legislature’s chart does not the amount or mill levy for each type of local government entity, because those entities which receive property tax monies (also called Ad Valorem Taxes), vary based upon the mill levies enacted for the particular city, town, special district or county.

The mill levy is the amount of tax collected per dollar of property value.

The mill levy can vary depending on where you live, what services you receive or what services are offered where your property is located.

A mill equates to one dollar of tax per thousand dollars of value of the property.

Property is assessed at its fair market value. Then, the value of the property is reduced by a reduction factor called the assessed value.

Residential and commercial property are assessed at 9.5 percent –meaning $100 thousand dollars of value are taxed at the reduced value of $9500. The number of mills for your property is multiplied by the reduced property value, and the result is the tax you pay on your property.

Property taxes are collected at the county level and remain local. None of the property taxes fund things like the operation of the state government, the legislature or the judiciary.

So, where are the property taxes spent? Wyoming, like every other state, funds our schools with property taxes. The issue in Wyoming is the mineral industry pays over half the property taxes.

Schools are largely funded by property taxes. Every piece of private real property is assessed for schools at 12 mills.In addition, local school districts have a 25 mill levy plus a six mill levy. Sources of school funds are shown in the legislative graph.

As you can see from the graph, the vast majority of school funding comes from property taxes.

Community colleges have the statutory authority to levy up to 4 mills.

If the community college board of trustees or voters approve additional college levies, the colleges can levy up to 10 mills for their operation.

Most community colleges levy 4 mills, except Gillette College, which levies 3 mils.

County commissioners can levy up to twelve mills to fund their operations. Every county in Wyoming levies the full twelve mills except Teton County and Campbell County, which have elected to not to levy the maximum mills to fund their operations.

Cities and towns, through their councils, can levy up to eight mills. Seventy-nine of the ninety-eight municipalities impose the maximum mill levy.

Additionally, if the voters approve a bond issue to build a local facility, additional mills can be added to fund the debt repayment.

Special Districts also have taxing authority. Hospital districts, which are special districts for example, have the ability to levy up to 3 mills statutorily.

Additionally, those hospital districts can ask the voters to approve an additional 3 mills if the healthcare needs of the community require additional taxes and the voters approve those taxes.

Many special districts such as water and sewer districts, elder care districts, fire districts, cemetery districts or weed and pest districts have statutorily authorized mill levies, that vary with the type of district and the statutory authorization.

Property taxes fund the governments closest to the people, the local governments and schools.

Cutting property taxes, as the distribution statutes currently exist, will cut revenue to schools, community colleges, cities, towns, counties, and special districts like hospital districts.

The functions of government affected will be local streets and roads, schools, police, sheriffs, fire departments, hospitals and other local functions.

The decreased property taxes will not affect other operations of government entities like highways, prisons, the judiciary or the general operation of the state functions.

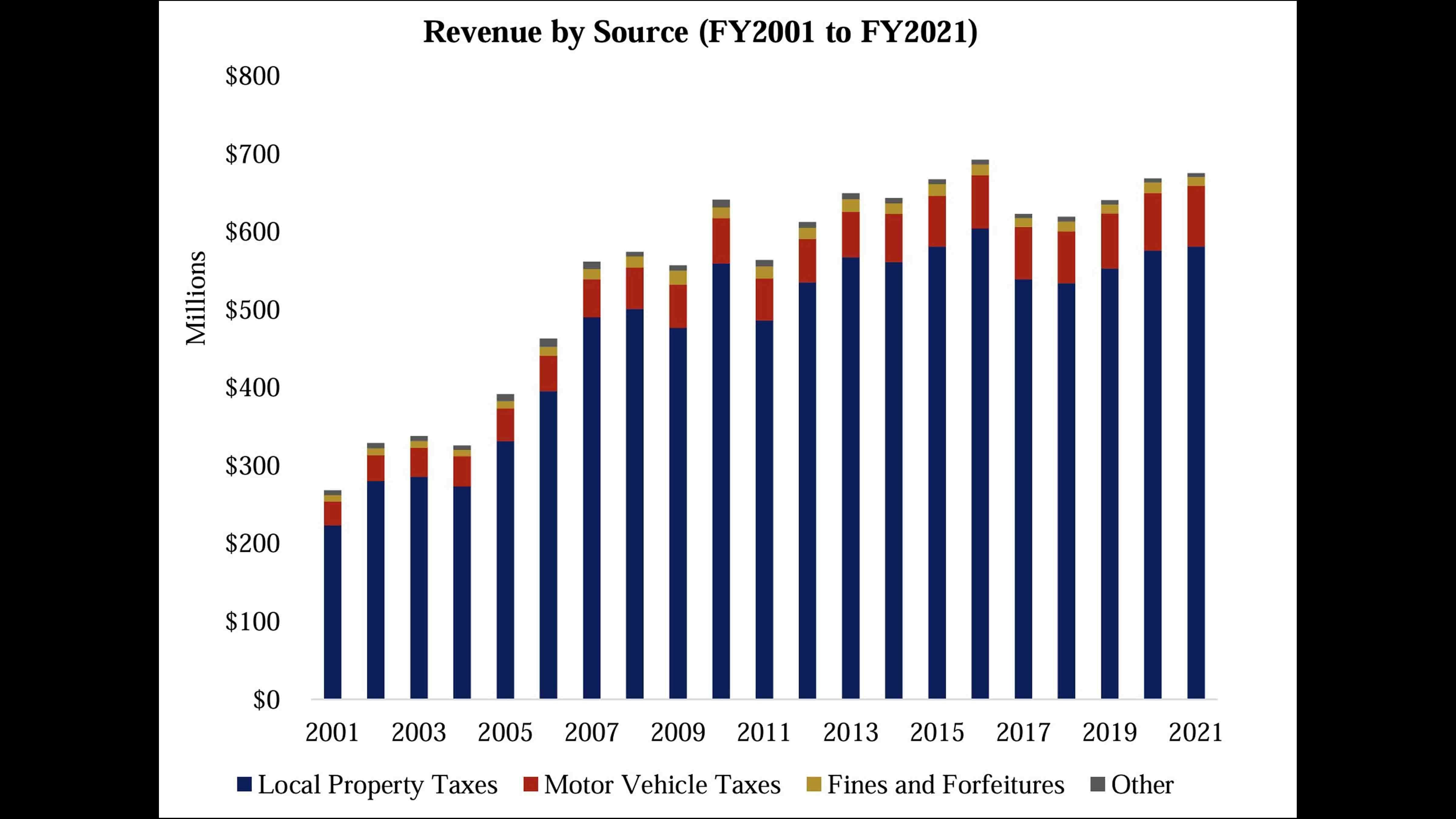

Wyoming taxes are volatile and depend on forces outside Wyoming, like the price and demand for real estate.

Since over half of our property taxes are paid by the fossil fuels industry, over half our tax base varies with the price and demand for fossil fuels.

In large measure, the revenue of the State of Wyoming depends on factors far outside the control of the people of Wyoming.

What we know about the volatile nature of Wyoming property taxes is that the tax situation this year, will be different than the tax situation next year.

In 1998, the State of Wyoming was nearly bankrupt. Then, technological developments in the fossil fuels industry caused a huge boost in mineral taxes.

Trends, now, indicate a future where fossil fuels demand is reduced, no matter what the people of Wyoming think.

Tom Lubnau served in the Wyoming Legislature from 2005 - 2015 and is a former Speaker of the House.